Grow Loans Without Growing Headcount

CompleteBankData is your search engine for local loan opportunities

We are Big Data for Small Banks

(Even Yours!)

Find More of Your Best Customers

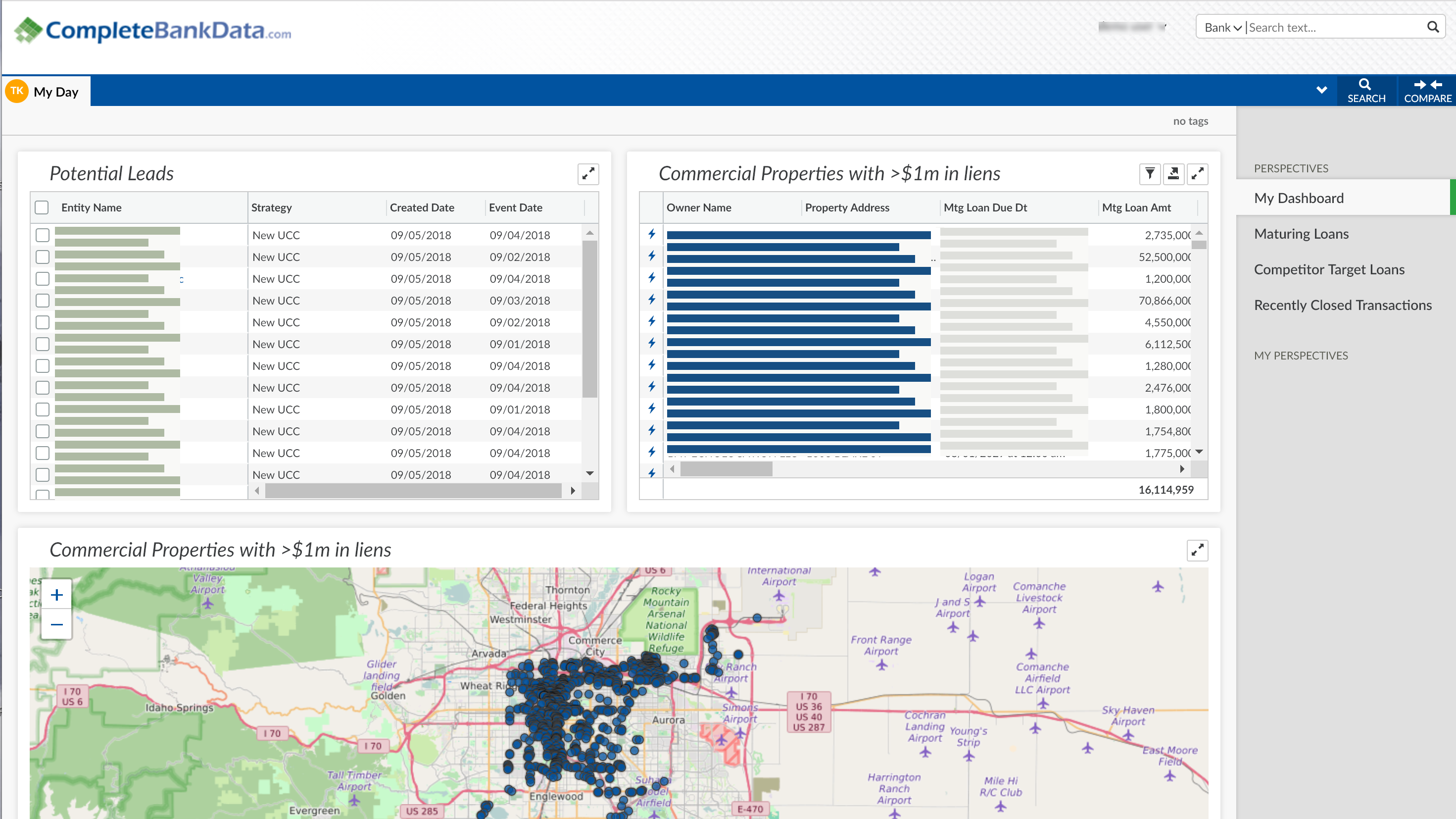

Discover potential borrowers in need of financing today. Our unique algorithms can uncover lucrative lending relationships you didn’t know existed.

Level Up Existing Lenders

Our system delivers each lender pre-screened credit opportunities in their market. You set the strategy and our system ensures that your lenders are doing what they do best, closing deals, not fishing for contacts.

Full CRM Integration

CompleteBankData supports integrations with all major CRM’s allowing your lending team to prospect, qualify and then send leads to your CRM for internal tracking.